"luslus"

4.只要打平或有賺就持續收縮兵力,期將定期定額精簡化

L大師:

弟子愚昧;

這點可否說得再清楚些?是將現有定期作收縮兵力停扣的意思嗎?

謝謝

ronccf

"luslus"

4.只要打平或有賺就持續收縮兵力,期將定期定額精簡化

luslus

"ronccf""luslus"

4.只要打平或有賺就持續收縮兵力,期將定期定額精簡化

是將現有定期作收縮兵力停扣的意思嗎?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"luslus"原則上亞股.東歐.拉美3大區和原物料至少要留一支,另外美歐也會考慮

故最精簡手上定期股基至少還是會持4-6支

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"ronccf"多謝L大回文

ronccf

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

luslus

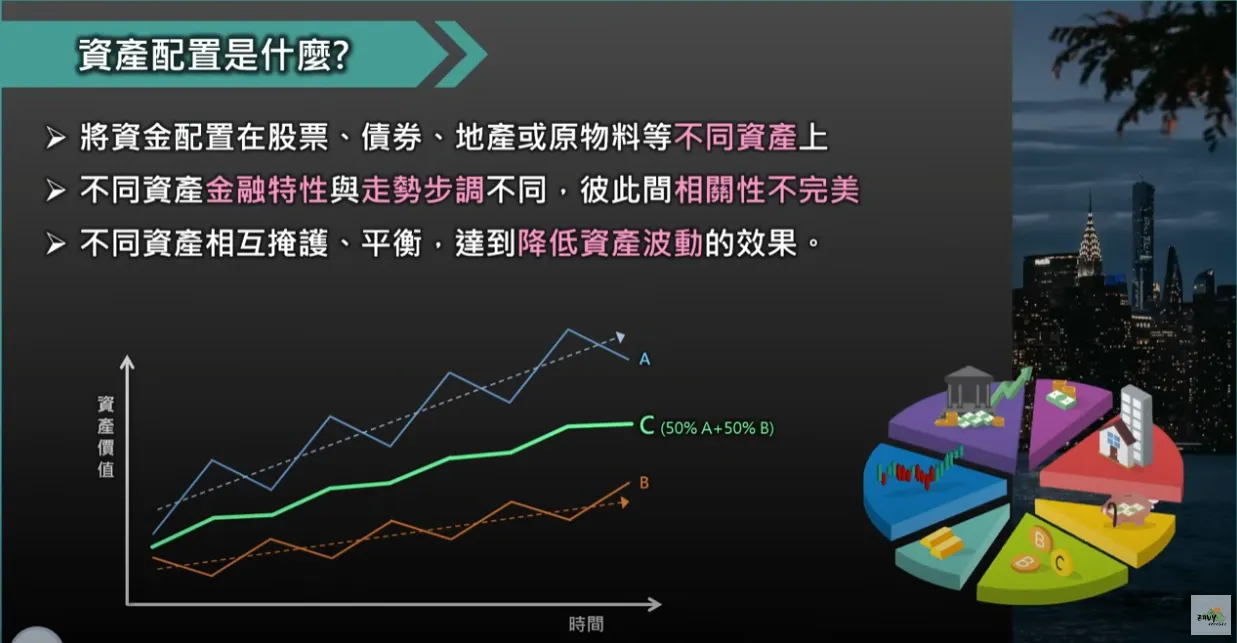

"ronccf"鄙見是股,債得比例應該位於資產配置的較上層,有"空閒"才來看下位階的配置

luslus

"fundhot"過去都是用單一國家組成區域型,

好處是各個國家可拆開收割或加碼,正報酬的機會大。

缺點就是投入資金相對較大,套句L大的話:弄得「生活不單純」。

我想,若學習L大各區域只擺一兩檔老字號的股基,讓國家間的轉換就交給這些經驗老道的基金經理人,自己專心在債基的領息及高收債的進出

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"fundhot"東歐:貝萊德新歐(請問有東歐小型的基金嗎?)

ronccf

"fundhot""fundhot"東歐:貝萊德新歐(請問有東歐小型的基金嗎?)

正思考用安本環球東歐股票基金A2歐元取代之。

理由:

1. 俄羅斯比重最低,僅44.3%。

2. 土耳其+波捷匈的比重高,佔43.7%。

請蹂躪。

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"ronccf""fundhot""fundhot"東歐:貝萊德新歐(請問有東歐小型的基金嗎?)

正思考用安本環球東歐股票基金A2歐元取代之。

理由:

1. 俄羅斯比重最低,僅44.3%。

2. 土耳其+波捷匈的比重高,佔43.7%。

請蹂躪。

小弟較保守,用瑞萬通博新興東歐債AM(USD)原幣+瑞萬通博新興東歐債AM(EUR)台幣+宏利土耳其(持續等待中)

請蹂躪,too

ronccf

"luslus"R大應該是認為目前這樣組合起來

整體報酬率會較佳!

luslus

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"luslus"一些存活久.有口碑.常得獎的老基金,還是有一定的操作水準在,相較之下令人有信心些

況誰也不知何時會輪到純東歐股基組合暴衝(像最近東協諸國一樣),

EX:今年初有幾個人看好印度,但是印度現在如何?現在網路上大讚印度,馬後炮的文章一大堆....

去年底有多少文章雜誌看好今年金價定破2000,還有人喊到3000,現在是多少呢?此一時,彼一時

股.債不管比重如何,還是加減都要配置一點

ronccf

ronccf

"fundhot"

台:統一大滿貫

亞:安本亞小

美:瑞銀美小

歐:景順歐企

拉美:柏瑞拉小(有買不到的問題)

東歐:貝萊德新歐(請問有東歐小型的基金嗎?)

礦:貝萊德世礦

油:景順能源(有買不到的問題)

公用:富坦公用(我選季配)

品牌:百達品牌(奢侈品)+MS品牌(消費品)

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"ronccf"普信美國小型公司股票型基金 http://www.moneydj.com/funddj/yp/yp011001.djhtm?a=MAR08與瑞銀美小,請強大評論一下

缺點是要到總代理萬寶投顧開戶,一懶起來,拖拉就過了快2年

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"ronccf"6區域4類股,真是難抉擇!

仍然不看好生技醫藥?

luslus

"fundhot""ronccf"6區域4類股,真是難抉擇!

仍然不看好生技醫藥?

最近國家地理頻道播了不少二戰紀錄片,居然是彩色的,很炫。

某部片子說到滇緬遠征軍在長征時,如果夥伴受傷,也只能拋棄,只為保存戰力。

為了聚焦,所以作出擱下部分夥伴的決定,例如生技、農金、地產、消閒。

手心手背都是肉。

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"yelindream"強大沒考慮黃金基金嗎??東協也直接放棄嗎??

luslus

"fundhot""yelindream"強大沒考慮黃金基金嗎??東協也直接放棄嗎??

黃金聖衣R大

ㄏ...應該是黃金聖戰士R大

當然不可能放棄東協,這也是我選擇老朋友安本亞洲小型公司基金的主因,注意看他的國家比重,東協已經超過一半了,而且沒有一般東協基金新加坡比重佔四成的問題。

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"luslus""fundhot""yelindream"強大沒考慮黃金基金嗎??東協也直接放棄嗎??

當然不可能放棄東協,這也是我選擇老朋友安本亞洲小型公司基金的主因,注意看他的國家比重,東協已經超過一半了,而且沒有一般東協基金新加坡比重佔四成的問題。

挑基金跟著"選基聖手"--強大就對了!

ronccf

"fundhot"

如果沒有L穆兵法指引,再會挑基金也沒用。

一檔基金賺錢但整個帳戶賠錢,就像贏了小戰鬥卻輸了整個戰役,意義不大。

請教專業前輩,強美金時間是否該換美金,繼續定期定額買基金?

分享學習資產配置-因應未來股市大幅回調

27歲投資ETF及股票基金的配置方向

日本升息、美國降息,定期定額日本基金的幣別選擇

透過富x人壽買野村優質基金,定期定額28個月報酬率-50%

想轉換定期定額投資標的到台股基金

基金及正2ETF資產配置的投資心得分享