Dan Fuss:債券非泡沫,因為收益建立在合約上。

1.6K

Dan Fuss:債券非泡沫,因為收益建立在合約上。

1.6K

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

樓主

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

樓主

2012-12-06 11:05

http://www.reuters.com/article/2012/11/ ... FT20121128

"I wouldn't call (this market) a bubble - I'd call it a very strong market, It's hard for bonds to bubble. It's easy for them to go the other way but it's hard for them to bubble because you're dealing with fixed contracts."

"There's a limit you say 'Oh My Goodness, it was issued at 100 and it goes to 116' and you think that's a bubble - no that's not a bubble," said Fuss, eating chocolate ice cream. He was referring to the price of a bond that trades 16 points above its face value of 100 cents on the dollar. "If it goes to 250, that's a bubble and that doesn't tend to happen with bonds."

PS. 國內知名度較低的Dan Fuss,其實是債券經理人推崇的債券專家。雖然國內也有媒體把他跟葛洛斯都稱為債券天王,但我比較喜歡路透給的這個名稱「債券導師」(Bond Guru),可知這位79歲老人的份量。

前往

1-1頁|共1則

相關討論

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

強勢雲

月

週

日

你可能會喜歡

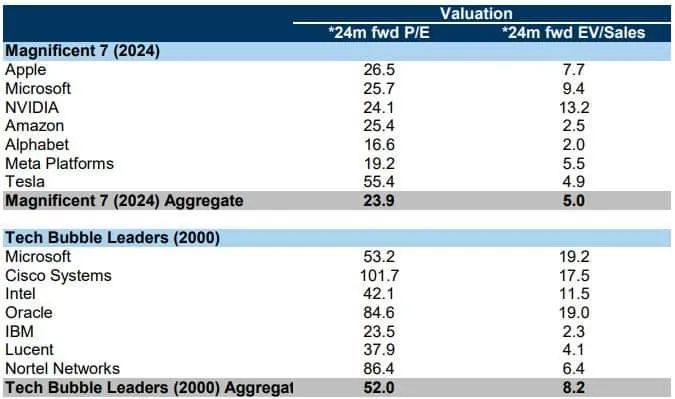

2000年網路泡沫與2024年AI熱潮的科技巨頭本益比比較

2024-09-14 hawk發表

總經觀點

請問「富蘭克林坦伯頓新興國家固定收益基金」最近漲的原因?

2024-04-10 rexzone發表

債券基金

科技股太貴泡沫已現?台股日股還能買?債券有賺頭?(強大觀點X野村展望)

2024-04-09 強大發表

總經觀點

信貸250萬投資安聯收益成長、南非幣高盛高收債新興債

2024-02-29 orqtzj發表

債券基金

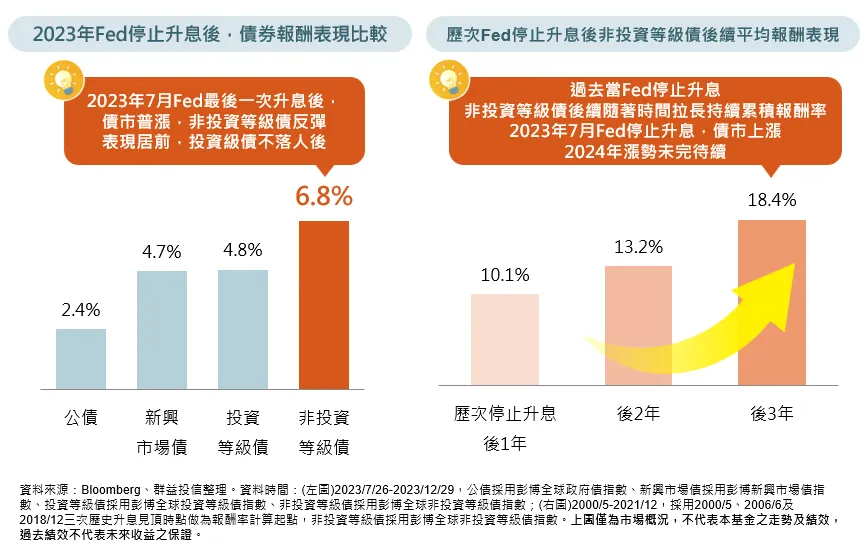

秒懂「群益時機對策非投資等級債券基金」,正是進場時機

2024-02-20 8d8d發表

債券基金

為何國人寧願投資安聯收益成長,而不願投資SPY?

2024-02-07 Chest_Ycc發表

債券基金

富蘭克林華美多重資產收益基金南非幣分配型調升配息了

2023-10-04 gamester發表

債券基金