如何分析美國12月PMI? 礦業有機會嗎?

如何分析美國12月PMI? 礦業有機會嗎?

KIKO

2. Continued strong demand for product and strong forecast for next year.” (Nonmetallic Mineral Products)

請問強大如何看這兩個產業的分析呢?

第一季,礦業是否有向上拉的機會?

明年非金屬礦產品的強勁,應該偏向投資甚麼樣的產業呢?

KIKO

FOR RELEASE: January 3, 2017

DO NOT CONFUSE THIS NATIONAL REPORT with the various regional purchasing reports released across the country. The national report’s information reflects the entire United States, while the regional reports contain primarily regional data from their local vicinities. Also, the information in the regional reports is not used in calculating the results of the national report. The information compiled in this report is for the month of December 2016.

PMI® at 54.7%

New Orders, Production and Employment Growing

Inventories Contracting

Supplier Deliveries Slowing

(Tempe, Arizona) — Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 91st consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “The December PMI® registered 54.7 percent, an increase of 1.5 percentage points from the November reading of 53.2 percent. The New Orders Index registered 60.2 percent, an increase of 7.2 percentage points from the November reading of 53 percent. The Production Index registered 60.3 percent, 4.3 percentage points higher than the November reading of 56 percent. The Employment Index registered 53.1 percent, an increase of 0.8 percentage point from the November reading of 52.3 percent. Inventories of raw materials registered 47 percent, a decrease of 2 percentage points from the November reading of 49 percent. The Prices Index registered 65.5 percent in December, an increase of 11 percentage points from the November reading of 54.5 percent, indicating higher raw materials prices for the 10th consecutive month. The PMI®, New Orders, Production and Employment Indexes all registered new highs for the year 2016, and the forward-looking comments from the panel are largely positive.”

Of the 18 manufacturing industries, 11 are reporting growth in December in the following order: Petroleum & Coal Products; Primary Metals; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; Apparel, Leather & Allied Products; Paper Products; Machinery; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Fabricated Metal Products; and Chemical Products. The six industries reporting contraction in December — listed in order — are: Plastics & Rubber Products; Furniture & Related Products; Printing & Related Support Activities; Textile Mills; Nonmetallic Mineral Products; and Transportation Equipment.

WHAT RESPONDENTS ARE SAYING …

■“Ramping up for year-end by reducing inventory.” (Chemical Products)

■“Very strong month in terms of booking and billing which will contribute to a good overall year revenue-wise.” (Computer & Electronic Products)

■“Our business remains strong and we are seeing continued growth.” (Plastics & Rubber Products)

■“We have been fairly steady the last few months and it appears business is strong into the 1st quarter of next year.” (Primary Metals)

■“Moving into [a] more inflationary environment, with lots of pressure to increase prices on a number of fronts.” (Food, Beverage & Tobacco Products)

■“Business continues to be brisk with an uptick of RFQs. Customers are earmarking funds for capital equipment upgrades.” (Machinery)

■“Hiring still tight on available local labor. Business, by segments, still uneven. Some consumer markets very (seasonally) strong, but industrial markets lagging.” (Transportation Equipment)

■“Business conditions are good, demand is growing.” (Miscellaneous Manufacturing)

■“Continued strong demand for product and strong forecast for next year.” (Nonmetallic Mineral Products)

■“December 2016 is way ahead of December 2015.” (Fabricated Metal Products)

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"KIKO"1. We have been fairly steady the last few months and it appears business is strong into the 1st quarter of next year.” (Primary Metals)

2. Continued strong demand for product and strong forecast for next year.” (Nonmetallic Mineral Products)

請問強大如何看這兩個產業的分析呢?

第一季,礦業是否有向上拉的機會?

明年非金屬礦產品的強勁,應該偏向投資甚麼樣的產業呢?

謝謝你的報告。這是ISM發布的美國PMI報告,以美國當地市場為主,看得出新訂單好轉,景氣復甦。

關於你的問題:

1. 不確定是不是第一季發酵,但2017礦業很有機會;只要中國景氣也能配合落底後成長。

2. 「非金屬礦產品」組成多數跟蓋房子有關(水泥、砂石等),可以看出美國房市是樂觀的。

KIKO

"fundhot""KIKO"1. We have been fairly steady the last few months and it appears business is strong into the 1st quarter of next year.” (Primary Metals)

2. Continued strong demand for product and strong forecast for next year.” (Nonmetallic Mineral Products)

請問強大如何看這兩個產業的分析呢?

第一季,礦業是否有向上拉的機會?

明年非金屬礦產品的強勁,應該偏向投資甚麼樣的產業呢?

謝謝你的報告。這是ISM發布的美國PMI報告,以美國當地市場為主,看得出新訂單好轉,景氣復甦。

關於你的問題:

1. 不確定是不是第一季發酵,但2017礦業很有機會;只要中國景氣也能配合落底後成長。

2. 「非金屬礦產品」組成多數跟蓋房子有關(水泥、砂石等),可以看出美國房市是樂觀的。

謝謝強大的解說

想確認自己的判斷是否正確

最近礦業是有高漲,看來還可以繼續持有了

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"KIKO"最近礦業是有高漲,看來還可以繼續持有了

與你同行(以及很多潛水的強友......

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

大跌是學習的機會,分享如何調整心態跟想法

呼應2022停滯性通膨分析,參照1981雷根遇刺,川普槍擊會對美股長期趨勢產生影響嗎?

配息基金的每月配息如何不被扣匯費30元?

中國基金負40到50%要如何解套?

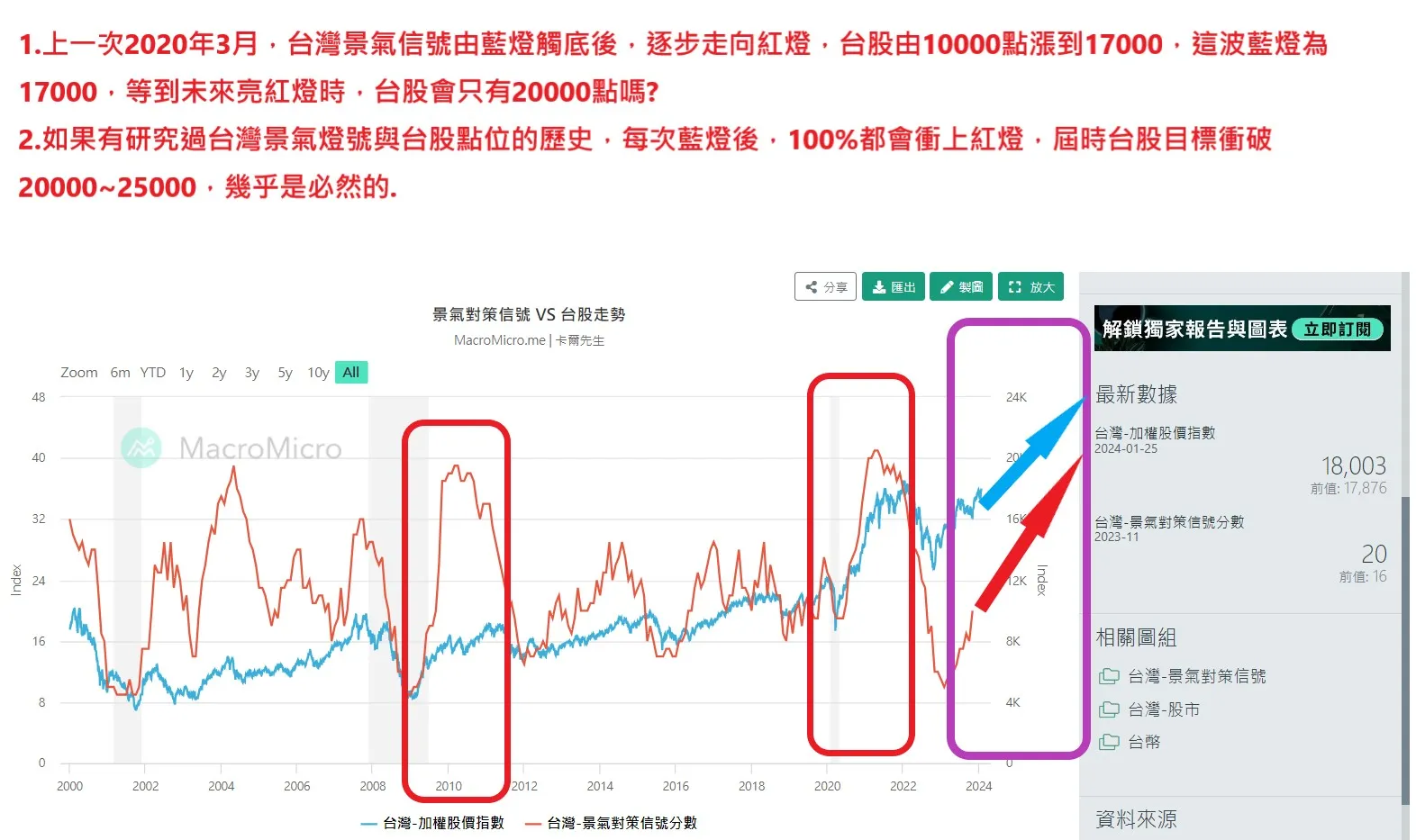

未來如台灣景氣信號出現紅燈,預期台股目標為2XXXX,應把握3或4月拉回加碼機會

呼應2023年1月2月低點分析,一旦歷史重演,五年後NASDAQ目標2XXXX

美元降息下買美債已經是公開的送分題,但美金貶值如何規避?