生技最近跌甚麼?

2.5K

生技最近跌甚麼?

2.5K

本用戶沒有設定簽名檔

xingsichuan

註冊會員

樓主

2014-04-24 09:24

http://www.fool.com/investing/general/2014/04/23/why-intuitive-surgical-netflix-and-amgen-are-today.aspx

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

2樓

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

2樓

2014-04-24 09:53

"xingsichuan"小弟搜到的一篇文章,或許可以為昨天生技產業作個註解

http://www.fool.com/investing/general/2014/04/23/why-intuitive-surgical-netflix-and-amgen-are-today.aspx

感謝大大分享,紅字是重點:

Lastly, shares of Amgen lost 5% Wednesday, taking a page from Intuitive Surgical and earning its sell-off by posting a lousy quarter. "Lousy" is relative, of course: sales were actually 6.6% higher in the first quarter than they were in the first quarter of 2013. Its best-selling drug, an arthritis treatment called Enbrel, nearly logged $1 billion in sales all by itself. Amgen took a real hit on its bottom line, where earnings per share, or EPS, fell from $1.88 in the first quarter of 2013 to $1.07 in the first quarter of this year. While that sounds like something investors shouldn't stand for, the bottom line was mostly hit by increasing R&D spending at Onyx, an oncology treatment company it acquired in October. So Amgen made less money last quarter because it's investing in ways to fight cancer -- not such a terrible thing, on second look.

銷售增加,但EPS因併購而下降。若此為真,不需過度擔心。

本用戶沒有設定簽名檔

xingsichuan

註冊會員

3樓

2014-04-24 10:08

"fundhot""xingsichuan"小弟搜到的一篇文章,或許可以為昨天生技產業作個註解

http://www.fool.com/investing/general/2014/04/23/why-intuitive-surgical-netflix-and-amgen-are-today.aspx

感謝大大分享,紅字是重點:

Lastly, shares of Amgen lost 5% Wednesday, taking a page from Intuitive Surgical and earning its sell-off by posting a lousy quarter. "Lousy" is relative, of course: sales were actually 6.6% higher in the first quarter than they were in the first quarter of 2013. Its best-selling drug, an arthritis treatment called Enbrel, nearly logged $1 billion in sales all by itself. Amgen took a real hit on its bottom line, where earnings per share, or EPS, fell from $1.88 in the first quarter of 2013 to $1.07 in the first quarter of this year. While that sounds like something investors shouldn't stand for, the bottom line was mostly hit by increasing R&D spending at Onyx, an oncology treatment company it acquired in October. So Amgen made less money last quarter because it's investing in ways to fight cancer -- not such a terrible thing, on second look.

銷售增加,但EPS因併購而下降。若此為真,不需過度擔心。

強大說的是!

我的五大投資金律,開槓桿也能應付:

一、找對一路向上的標的

二、做好配置及現金比例

三、利用再平衡逢低買

四、有錢隨時買,按配置進場

五、長期持有,缺錢再賣

mrchildren

名人堂

4樓

2014-04-24 10:14

本用戶沒有設定簽名檔

xingsichuan

註冊會員

5樓

2014-04-25 11:01

摘錄自http://www.fool.com/investing/general/2014/04/24/why-xilinx-inc-biogen-idec-inc-and-qualcomm-incorp.aspx

不過小弟英文破得很,還請大大指點..

前往

1-1頁|共5則

相關討論

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

強勢雲

月

週

日

你可能會喜歡

請問健康護理醫療保健基金發生什麼事?

2024-11-19 eandc0901發表

股票基金

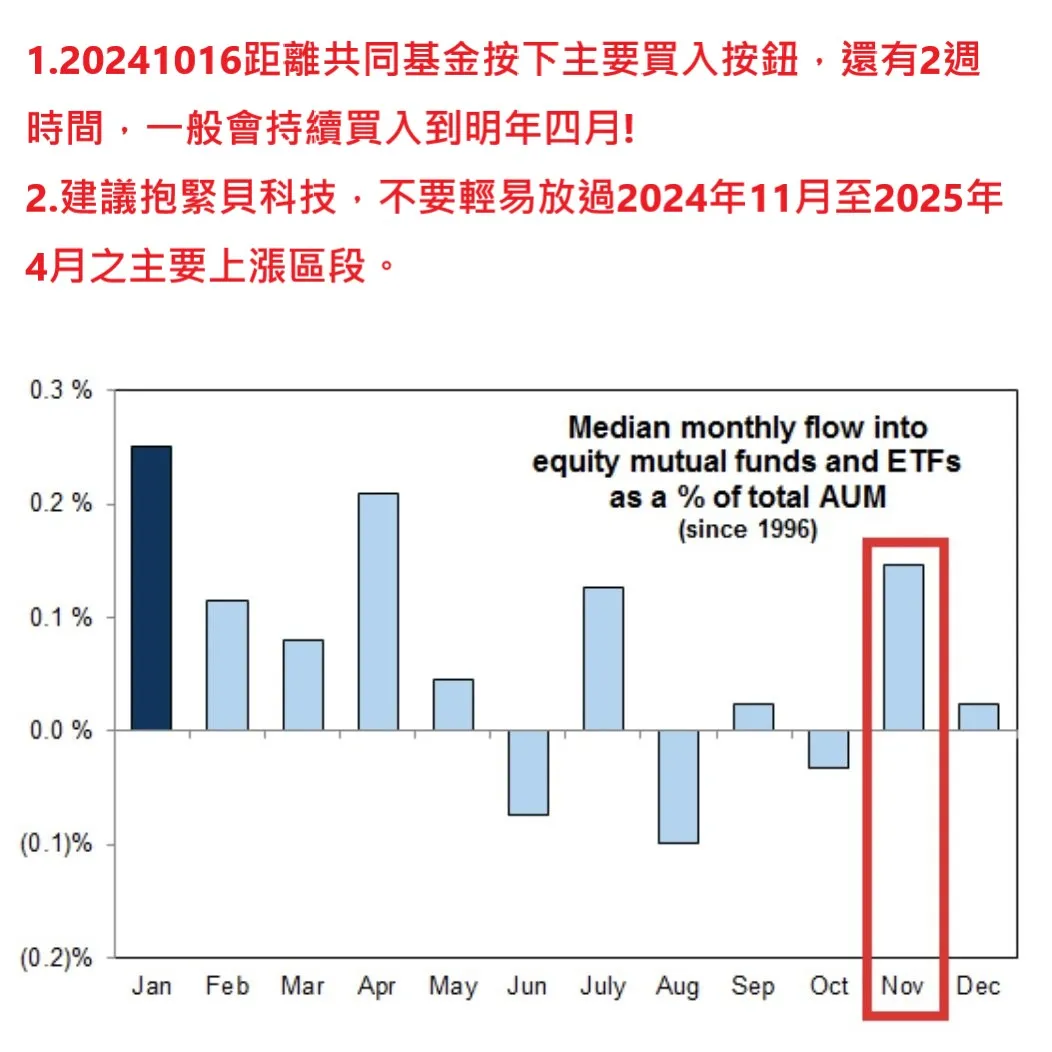

美股即將進入最甜美的年底區間,抱緊貝科技越來越考驗人性!

2024-10-30 chicky發表

天使

為什麼野村基金近期績效不佳?

2024-09-03 liru121發表

股票基金

真金白銀實證「10天跌10%」就是最佳進場訊號

2024-09-02 mrchildren發表

股票基金

正2ETF長期年化報酬率、近年來最大跌幅一覽

2024-08-13 faith發表

ETF

台股大跌1004點創史上最大跌點,讓子彈飛一下

2024-08-02 mrchildren發表

股票

生命中影響我最深的富人財商思維(親身經歷)

2024-07-04 faith發表

總經觀點