一線司令調任國防部長

898

一線司令調任國防部長

898

本用戶沒有設定簽名檔

ronccf

註冊會員

樓主

2013-08-04 16:04

因為我們被拔擢的理由,都是與現在的職務有關,但這些優點通常與被提升後的職務完全無關

情人與配偶的關係好像也適用,還好有愛

Paul Graham’s appointment as head of Growth strategies has led to a change in the management structure

--------------------------------------------------------------------------

A reduced role for long-standing manager Paul Graham as part of a three-man management team has diminished our conviction in UBS (Lux) EF Small Caps fund.(瑞銀美小)

This fund had been run by Paul Graham and David Wabnik from the mid-1990s until Nov 2012. Such stability is all too rare and Graham’s capabilities in particular were key to our favorable view of the fund. In Nov 2012, however, he was appointed head of UBS Growth Equity strategies and based on our discussions with the group, it is clear that the time he has to spend on this offering is materially curtailed.

We draw some comfort from the continued presence of David Wabnik. He had worked alongside Graham as comanager since 1995 and is further supported by Samuel Kim, who joined the team as an analyst in 2003 and was promoted to comanager in 2011. UBS also added an analyst in 2013; however, the new team member will only initially dedicate half of his time to this strategy.

We also note the team’s process remains unchanged under the leadership of Wabnik and Kim. The approach to research is based upon bottom-up analysis that aims to identify companies with above-average earnings and revenue growth. The resulting portfolio is home to 70-100 stocks, but investors should note that the sector exposures can be concentrated in a few areas. Indeed, the portfolio is dominated by stakes in the information technology, health-care and consumer goods sectors, which accounted for nearly two thirds of the fund at the end of Jan 2013.

Nevertheless, we regarded Graham’s expertise and full dedication to this strategy as crucial to our positive conviction. We believe the remaining dedicated managers are capable investors, and we acknowledge that Graham remains involved with the strategy. However, we expect his diminished role to have an impact on this relatively small team, particularly given the breadth of the US small-cap equities universe and its inherent risks. We have therefore downgraded the fund's rating to Neutral.

Nevertheless, we regarded Graham’s expertise and full dedication to this strategy as crucial to our positive conviction. We believe the remaining dedicated managers are capable investors, and we acknowledge that Graham remains involved with the strategy. However, we expect his diminished role to have an impact on this relatively small team, particularly given the breadth of the US small-cap equities universe and its inherent risks. We have therefore downgraded the fund's rating to Neutral.

引自2013/3/28晨星關於瑞銀美小的分析報告

有買這支的強友實戰感受呢?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

2樓

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

管理員

2樓

2013-08-04 18:04

從最近績效來看,瑞銀美小在「過去一年」輸最多,所以之前一度改扣摩根美小。不過近期已回穩,又重新納入配置組合。

本用戶沒有設定簽名檔

ronccf

註冊會員

3樓

2013-08-04 19:13

"fundhot"職場上常見優秀員工升為主管後開始胡作非為,業務領域尤其嚴重,只因「領導」應是個專業能力,現代企業卻多半拿來當作獎酬。

附議,總統這一行更嚴重

從最近績效來看,瑞銀美小在「過去一年」輸最多,所以之前一度改扣摩根美小。不過近期已回穩,

附議

又重新納入配置組合。

前往

1-1頁|共3則

相關討論

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

強勢雲

月

週

日

你可能會喜歡

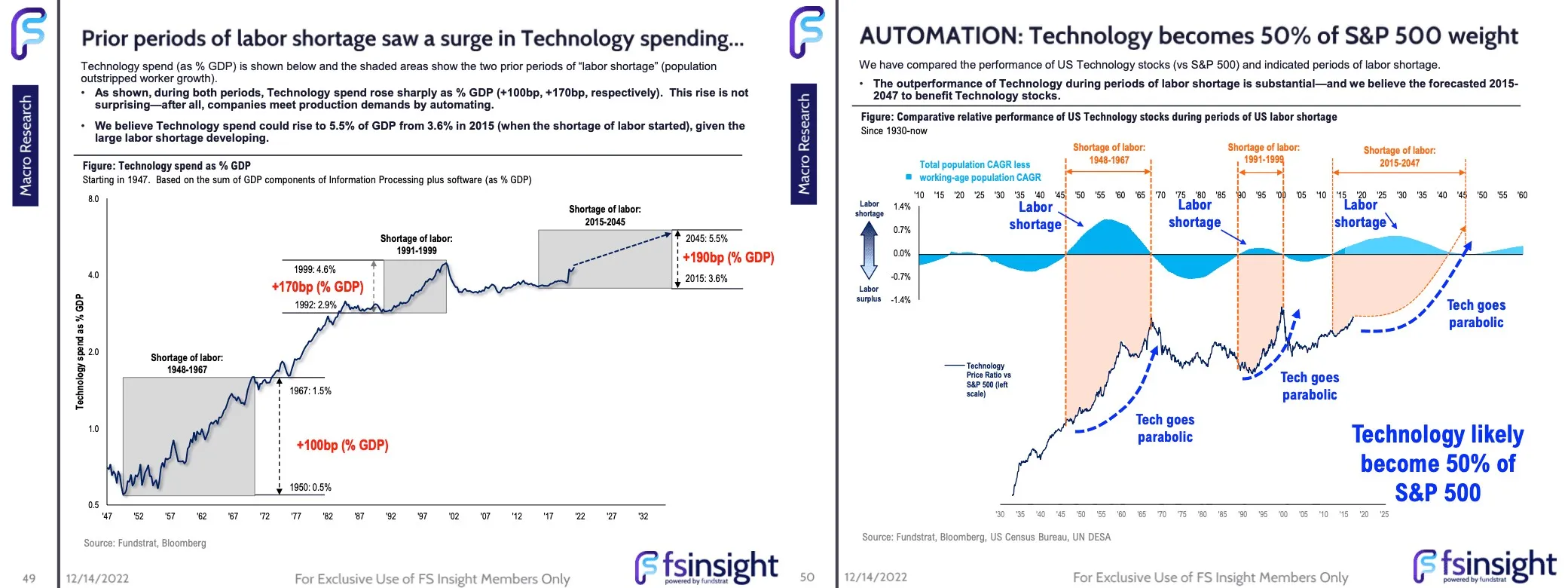

2025依舊看美國成長股表現!00924一年賺60%續抱緊

2024-11-13 faith發表

ETF

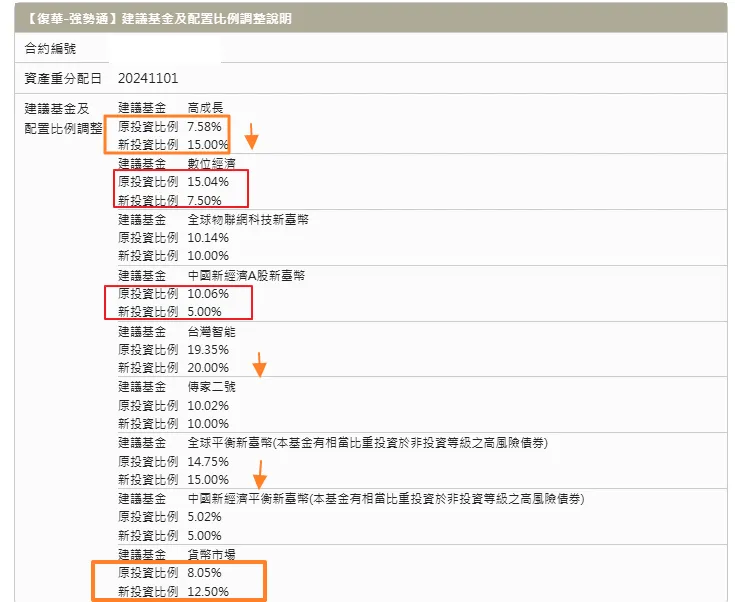

強勢通賣出部分中國新經濟A股、數位經濟,增加現金,因應美總統大選變局?

2024-11-06 Kkk1發表

天使

費半指數的線型剛完成底部型態,有機會再創新高

2024-09-29 8d8d發表

天使

美國增長基金終於翻正要贖回嗎?

2024-09-26 ancawang3發表

股票基金

摩根士丹利美國增長基金淨值越過前波高點,繼續往上

2024-09-19 herfeeya發表

股票基金

資金建議分長線與短線,長線部位成本低不動作,短線部位機動

2024-09-03 chicky發表

天使

尋找績效長線穩健向上而波動較小的基金或ETF

2024-08-26 iumjh1218發表

資產配置