希臘債務已經不能再當市場下跌的藉口了

希臘債務已經不能再當市場下跌的藉口了

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

http://www.cnbc.com/id/46667586

Strong Take-Up of Greece Bond Swap Offer

Published: Thursday, 8 Mar 2012 | 7:38 PM ET Text Size

By: Reuters

Greece successfully closed its bond swap offer to private creditors on Thursday, opening the way to securing the funding it needs to avert a messy default on its debt, according to several senior officials.

One official, speaking on condition of anonymity, said take-up of bonds regulated by Greek law, the most significant part of the overall debt , was around 95 percent.

The official said the figure referred to the voluntary take-up of the offer, however another official said it assumed the activation of collective action clauses (CAC) that would impose the deal on all creditors holding Greek law bonds.

teemo

後來有人貼這一篇文章給我

我才知道是歐洲人過太爽了才有歐債的

奇怪耶! 希臘~

欠了一屁股債,鄰國,也就是富有的鄰居們,借錢給他,助他度過難關。按理說,欠了錢,總該撙節支出吧!譬如說:「請你別再開賓士轎車、別再夜夜笙歌了。」但這沒落的貴族,卻依然故我,歌照唱、舞照跳,把「撙節支出」這檔事,拋在腦後。國家都快破產了,卻還把選票投給主張反對撙節的左派小黨。選舉結果出爐後,當選者卻改口說:「要留在歐元區,不要撙節方案!」

網路文章來自於 今周刊

完整文章連結

http://www.businesstoday.com.tw/v1/cont ... 0120503442

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

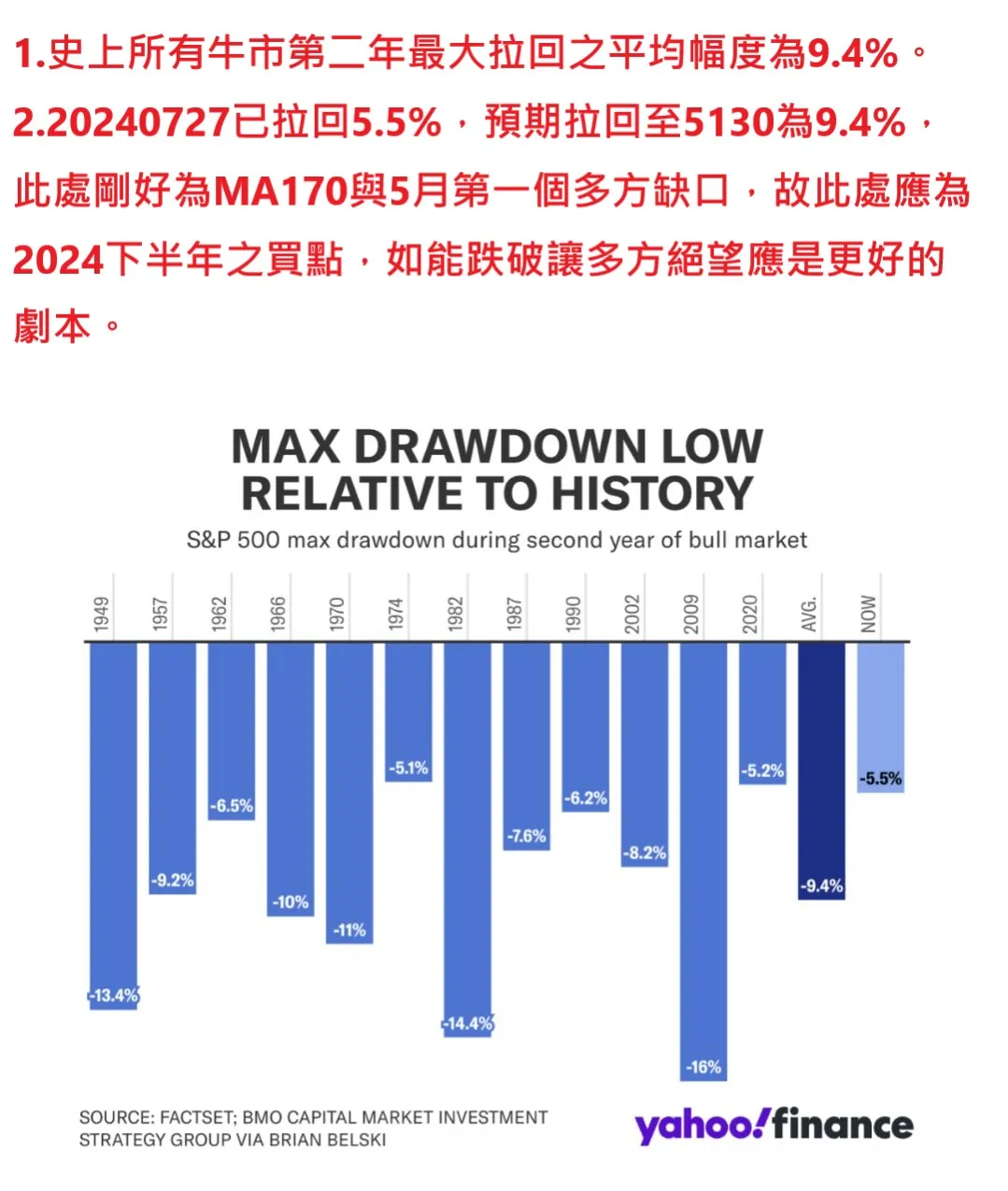

呼應20240713降息預估,SPX拉回已達牛市第二年之平均跌幅,建議後續動作

已買主動基金還需要再買市值型ETF嗎?

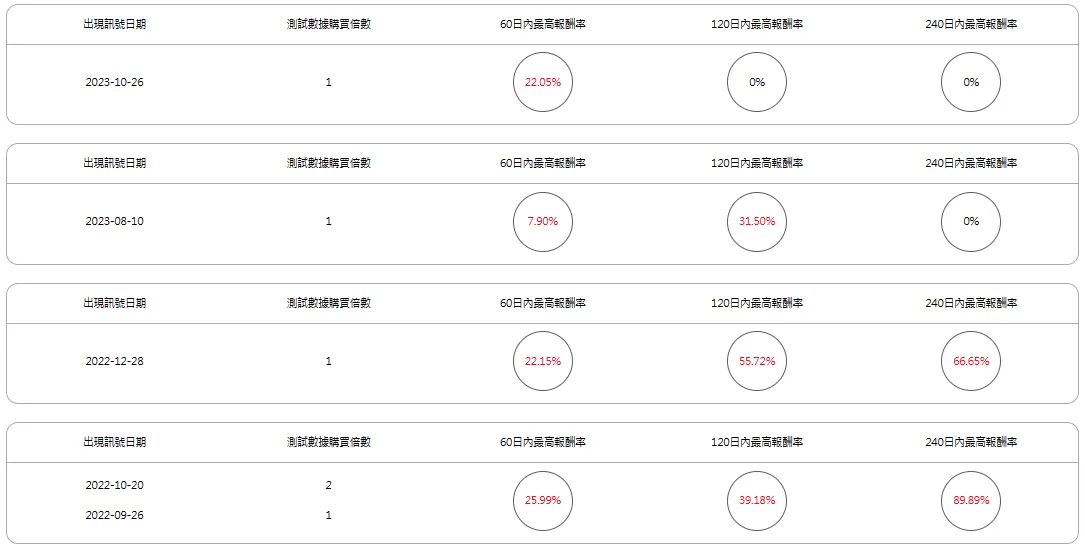

股市跌不停何時可進場?強AI出訊號:就是現在!

新興市場債券基金南非幣計價高配息的選擇

2024年降息機率大,新興市場債進場時機浮現

美元降息下買美債已經是公開的送分題,但美金貶值如何規避?

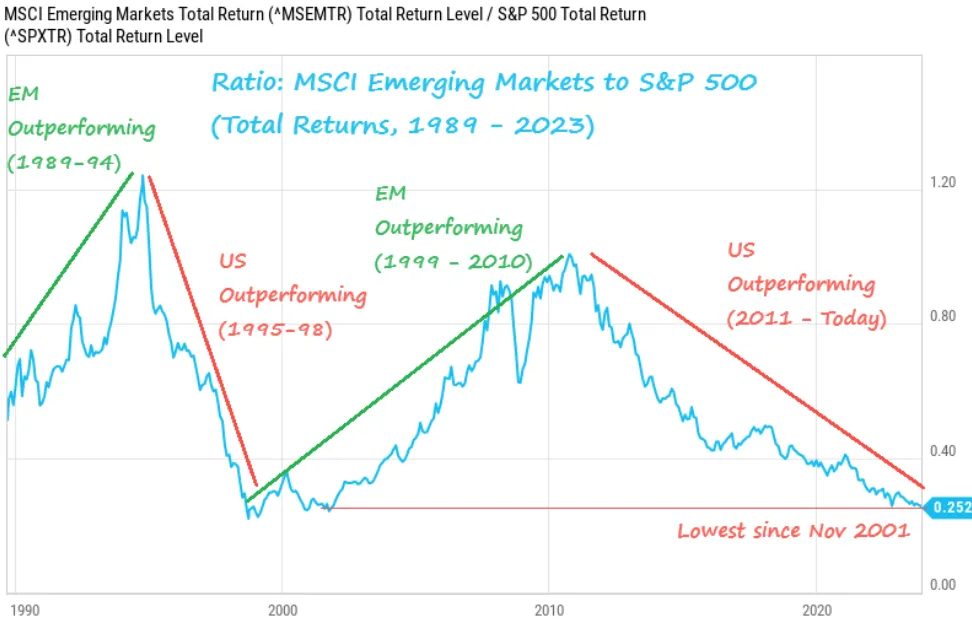

新興市場對比美股,已來到過去2001年的超級甜蜜點