"ronccf"PS

對可轉換債的看法如何?

真是問對人了,我困擾已久。

我一直搞不懂這個產品,不像債券又不像股票。如果想當債主領息,單純買債就好了,不需要買這個既無息亦無擔保的產品。如果看好股價上漲,買股或參與IPO就好了,何必要先買債之後看情況轉成股?現金不就是最好的Switch?

查了一下,國內幾檔可轉債基金表現並不好,最近一季不僅輸給高收債,連投資級都贏不了,那又何必冒風險呢?

R大為何有此一問?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"ronccf"PS

對可轉換債的看法如何?

ronccf

Ivy

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"Ivy"期初約定到期可轉債為股的價位,接近發行時的股價

到期時股票價格已大大改變(所幸是大漲),許多同事都選擇換為股票^^

Ivy

"fundhot""Ivy"期初約定到期可轉債為股的價位,接近發行時的股價

到期時股票價格已大大改變(所幸是大漲),許多同事都選擇換為股票^^

請問,如果股票價格是下跌呢?該怎麼辦?繼續持有債券有利息嗎?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"Ivy""fundhot""Ivy"期初約定到期可轉債為股的價位,接近發行時的股價

到期時股票價格已大大改變(所幸是大漲),許多同事都選擇換為股票^^

請問,如果股票價格是下跌呢?該怎麼辦?繼續持有債券有利息嗎?

股價跌,可以不用選擇換股票,持有債券到期終止取回本息,比定存還可口唷~

Ivy

"fundhot"

IVY大,請問我這樣理解對不對:

到期前持有可轉債是無息的,到期前終止取回本金,頂多損失利息的“機會成本”。

到期後若股漲可轉股,賺取資本利得。若股跌繼續持債,賺取比定存優的利息。(好奇請問是多優?)

sabine

"fundhot""ronccf"PS

對可轉換債的看法如何?

真是問對人了,我困擾已久。

我一直搞不懂這個產品,不像債券又不像股票。如果想當債主領息,單純買債就好了,不需要買這個既無息亦無擔保的產品。如果看好股價上漲,買股或參與IPO就好了,何必要先買債之後看情況轉成股?現金不就是最好的Switch?

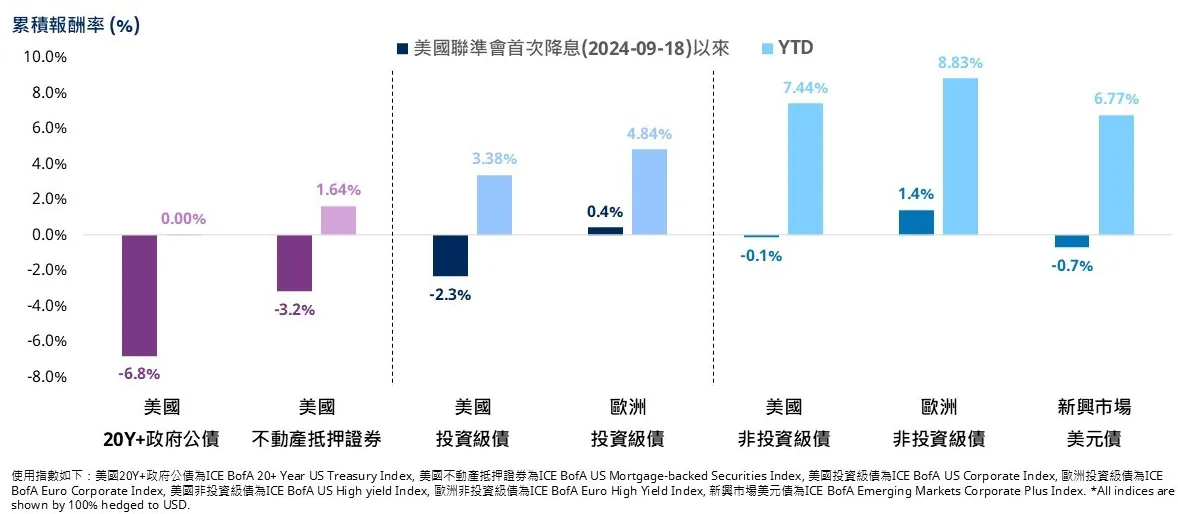

查了一下,國內幾檔可轉債基金表現並不好,最近一季不僅輸給高收債,連投資級都贏不了,那又何必冒風險呢?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

"sabine"查了一下可轉債的相關文章,看到很久以前強大的文不看好可轉債,近日強基金新增了一檔摩根士丹利環球可轉債,

https://fundhot.com/fund/detail/MD1001102

看起來績效很不錯,且一路向上。

過了幾年,強大對於可轉債有新的想法嗎?

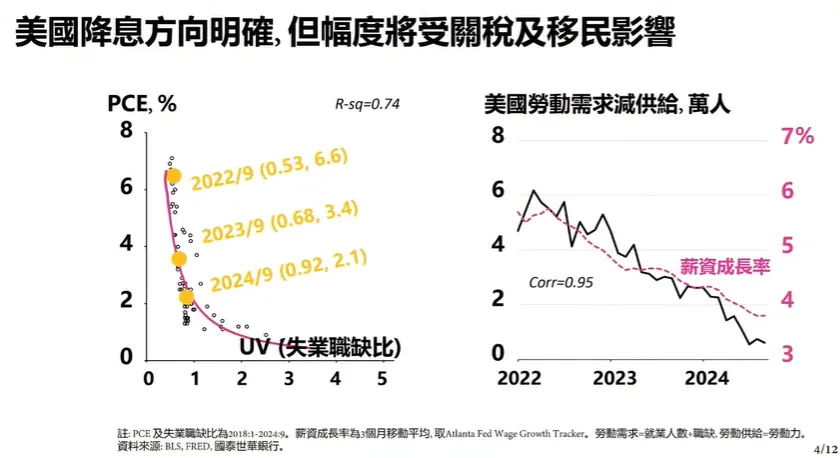

溫和降息+川普2.0,債券投資關鍵字也確定了!

美股台股明年再創新高!2025全球投資趨勢論壇藏金圖分享

請問健康護理醫療保健基金發生什麼事?

請教專業前輩,強美金時間是否該換美金,繼續定期定額買基金?

【請益】面對2025,高點買的非投等債該轉換?還是繼續持有?

2025與神同賺!投資趨勢大預言